Digital accounting – going paperless as a source of competitive advantage for companies

22 May 2025

22 May 2025

Digital accounting is no longer a choice – it is becoming a necessity for companies that want to operate faster, more securely, and more consciously. Clinging to paper documents, manual data entry and archive binders increasingly means risk: slower operations, higher costs, and loss of competitive advantage.

Implementing modern digital systems not only improves data quality and accelerates daily work, but also strengthens information security and regulatory compliance. Today, digital accounting is also a key element in building the image of a responsible organisation ready for the challenges of the modern market.

The implementation of digital accounting systems significantly reduces the number of errors and speeds up data verification processes. Automatic document validation, real-time tax compliance control and the ability to track the history of changes eliminate basic sources of risk.

In practice, this means:

Moreover, thanks to automation, accounting departments can play a more strategic role within the organisation, providing reliable data needed for accurate business decision-making.

Digital accounting facilitates the streamlining of internal communication. Automated invoice approval processes, immediate access to up-to-date financial data and the ability to share documents between departments significantly shorten operation times and minimise the risk of errors.

In hybrid working models and organisations with dispersed teams, digital solutions are becoming essential tools to ensure the fluidity and transparency of financial processes.

By building stronger organisational structures, companies that invest in digital accounting gain flexibility and can react more quickly to changing market conditions.

Data security and regulatory compliance are now fundamental to any responsible business activity.

Modern ERP solutions and integration with the National e-Invoicing System (KSeF) significantly increase control over information flow, while compliance with standards such as GDPR and ISO 27001 becomes easier through process automation.

In digital accounting, data is:

This eliminates the risk of document loss, ensures business continuity, and minimises the risk of legal non-compliance.

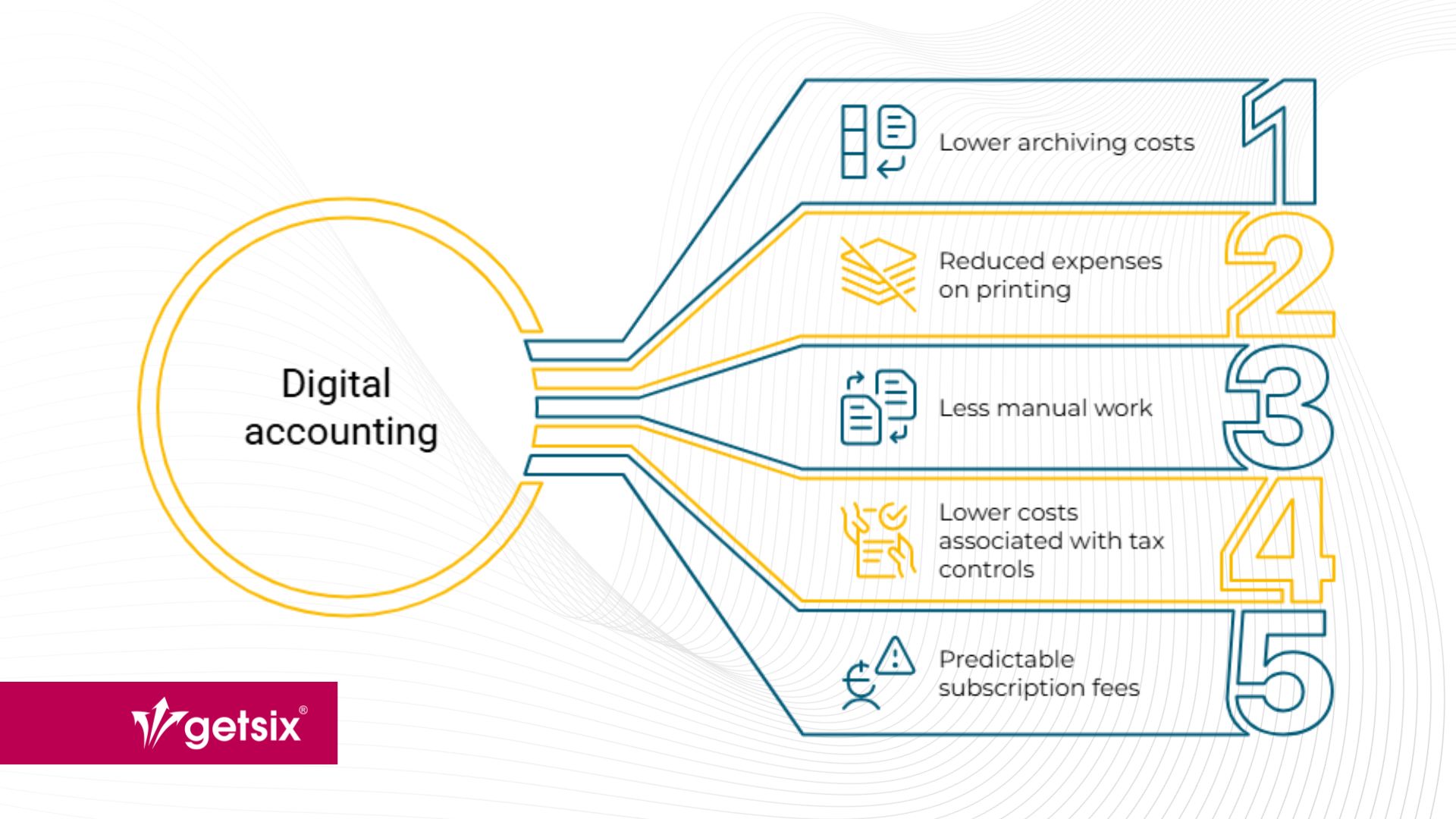

Moving to paperless accounting brings tangible financial benefits. Lower archiving costs, reduced expenses on printing and office supplies, and less manual work in document handling are just the beginning.

Additionally, automation of processes reduces costs associated with audits and tax controls, and predictable subscription fees for modern systems eliminate the risk of unexpected expenses.

At getsix®, we have been supporting companies in their digital transformation for years, using advanced technologies.

We offer implementations of Microsoft Dynamics 365 Business Central, which integrates all key areas of activity – from accounting, through sales, to warehouse management.

This platform provides:

Additionally, we implement solutions based on Power BI, enabling the creation of dynamic management and financial reports.

Real-time data analysis allows our clients to:

The digital transformation of accounting is today one of the key elements in building a modern, resilient organisation. It is an investment in greater efficiency, security, and stability of financial processes, as well as better talent management.

If you want accounting in your company to be a real support for business development – contact the getsix® team. We will show you how to implement digital change effectively and safely.

If you have any further questions or require additional information, please contact your business relationship person or use the enquiry form on the HLB Poland website.

***

Download the brochures providing general information and outlining the services that are offered by HLB member firms.

Learn moreClick below for more detailed information regarding population, major towns and cities, language, religion and holidays in Poland.

Learn more