Transfer pricing in Poland in 2025 – thresholds, limits and documentation

14 August 2025

14 August 2025

Transfer pricing in Poland in 2025 remains a focus for both tax authorities and businesses engaging in transactions with related entities. The regulations in this area are crucial for maintaining financial transparency, avoiding disputes with the tax office and minimizing the risk of penalties. In 2025, the rules continue to impose strict documentation requirements and provide for severe penalties for non-compliance, which is why many companies choose to seek professional support in the field of transfer pricing.

The transfer pricing regulations cover controlled transactions of a homogeneous nature between related entities – both domestic and cross-border. The documentation obligation arises once the transaction value exceeds the thresholds specified in the legislation. The purpose of the documentation is to demonstrate that prices were set on an arm’s length basis, as they would be between unrelated parties.

In addition to standard transactions, special attention is paid to dealings with entities in so-called tax havens, which have lower threshold limits and require additional business justifications.

Read more:

The documentation thresholds are determined separately for each homogeneous transaction and separately for the cost and revenue sides.

| Type of transaction | Documentation threshold |

|---|---|

| Goods | PLN 10 000 000 |

| Financial | PLN 10 000 000 |

| Services | PLN 2 000 000 |

| Other | PLN 2 000 000 |

For transactions with entities in tax havens:

Depending on the type of operation, this may be the capital value (loans, credits), nominal value (bond issuance), guarantee amount (sureties), allocated revenues/costs (foreign branches), or the value appropriate for the given type of transaction.

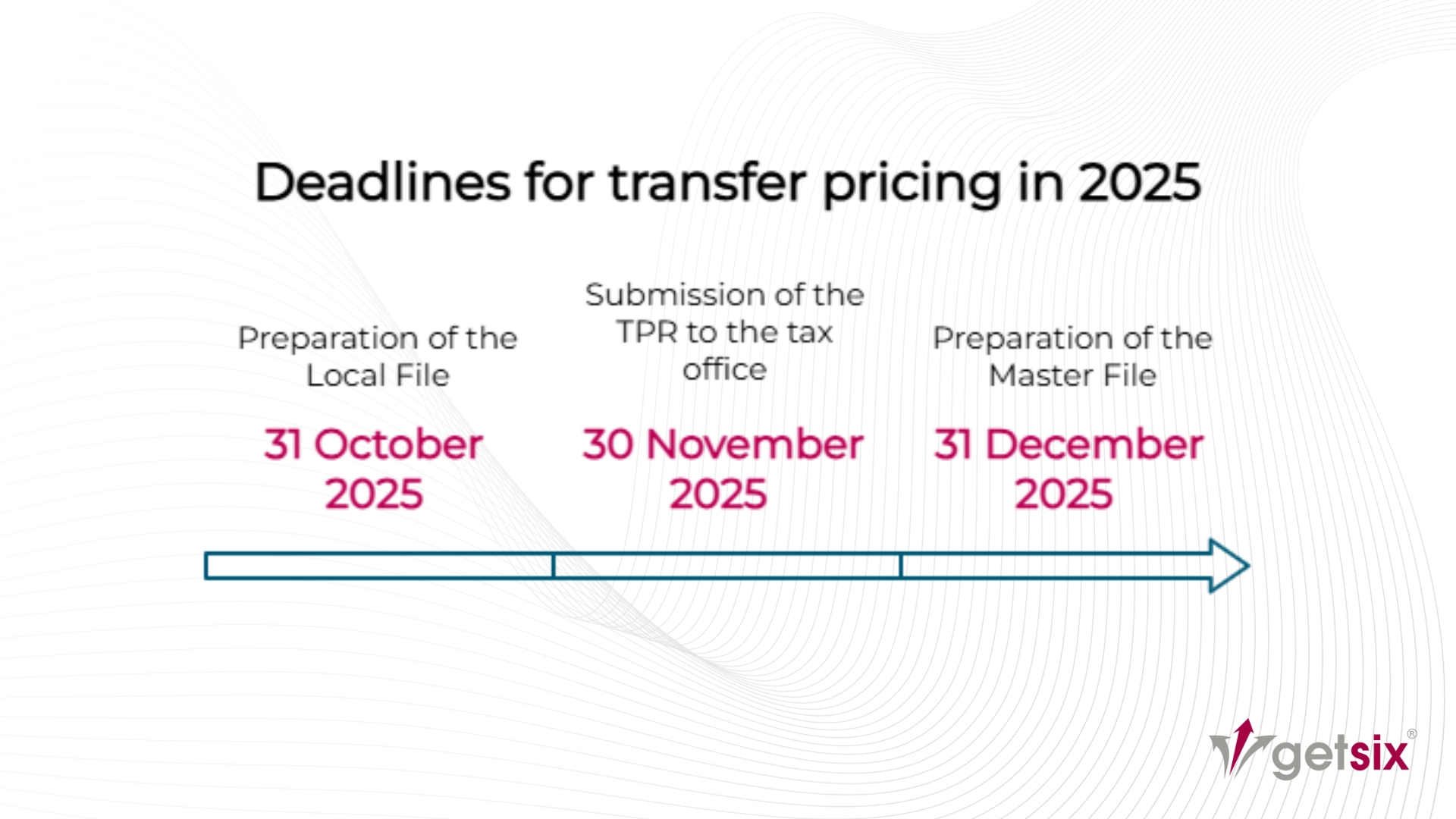

For taxpayers with a calendar-year tax year, the following deadlines apply:

For companies whose tax year does not coincide with the calendar year – by the end of the 10th, 11th, and 12th month, respectively, after the end of the tax year.

Transfer pricing rules in 2025 require that local documentation include, among other things:

Additionally, documentation must be prepared and stored in electronic form, as required by current regulations.

Not every related-party transaction in 2025 requires documentation. Exemptions include, among others:

Failure to comply with transfer pricing obligations in 2025 entails serious consequences:

Start by checking whether your transactions exceed the statutory limits. Remember, the value is determined separately for each homogeneous transaction and separately for costs and revenues. This will help you avoid unexpected documentation obligations.

Collect all data and materials relating to the transactions: contracts, invoices, pricing calculations, descriptions of the transaction subject, and economic analyses. This is the foundation for your Local File and TPR.

Verifying the arm’s length nature of prices is a key element of the documentation. The benchmarking or compliance analysis should be based on current data and tailored to your industry specifics. A well-prepared analysis can protect against tax authority challenges.

The Transfer Pricing Report must be fully consistent with the data in the Local File. Even minor discrepancies can trigger a tax audit, so an internal review before submission is advisable.

Do not leave documentation preparation to the last minute. Set interim deadlines for each stage – from data collection to analysis preparation and final review. Working in advance minimizes the risk of errors and time pressure.

Preparing transfer pricing documentation in Poland requires time, precision, and knowledge of current regulations. The earlier you start, the better your chances of avoiding mistakes and penalties. Contact us to ensure full support and tax compliance.

Transfer pricing in 2025 remains one of the most important areas of tax audits in Poland. Meeting deadlines is key, but so is properly preparing documentation in line with legal requirements. Proper process management – including a comparative analysis and compliance with the arm’s length principle – will help avoid high penalties and disputes with the tax administration.

Legal basis:

If you have any further questions or require additional information, please contact your business relationship person or use the enquiry form on the HLB Poland website.

***

Download the brochures providing general information and outlining the services that are offered by HLB member firms.

Learn moreClick below for more detailed information regarding population, major towns and cities, language, religion and holidays in Poland.

Learn more