EU slows down ESG implementation. CSRD directive delayed, but still mandatory

22 April 2025

22 April 2025

The European Union has decided to postpone key ESG obligations. By adopting the “Stop-the-clock” mechanism, companies have gained additional time to implement the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD). This decision is a long-awaited response to businesses’ concerns about excessive regulatory burdens and their organisational readiness.

This decision to postpone deadlines does not mean the EU is stepping back from its ambitious climate and social goals. On the contrary, it represents a move towards a more realistic implementation of ESG regulations. Above all, these changes aim to allow companies to better prepare for upcoming obligations without compromising the essence of these rules. In this context, the “Stop-the-clock” mechanism plays a key role in clarifying the implementation timeline.

“Stop-the-clock” is a mechanism adopted within the so-called Omnibus I legislative simplification package. Its primary objective is to give companies more time to implement new reporting and compliance obligations related to ESG. This change is a direct response to concerns expressed by the business community and the results of analyses indicating growing administrative burdens and potential regulatory chaos.

The mechanism was approved by the European Parliament on 3 April 2025 and formally endorsed by the Council of the EU on 14 April 2025, completing the legislative process. The new rules will enter into force on the day following their publication in the Official Journal of the EU.

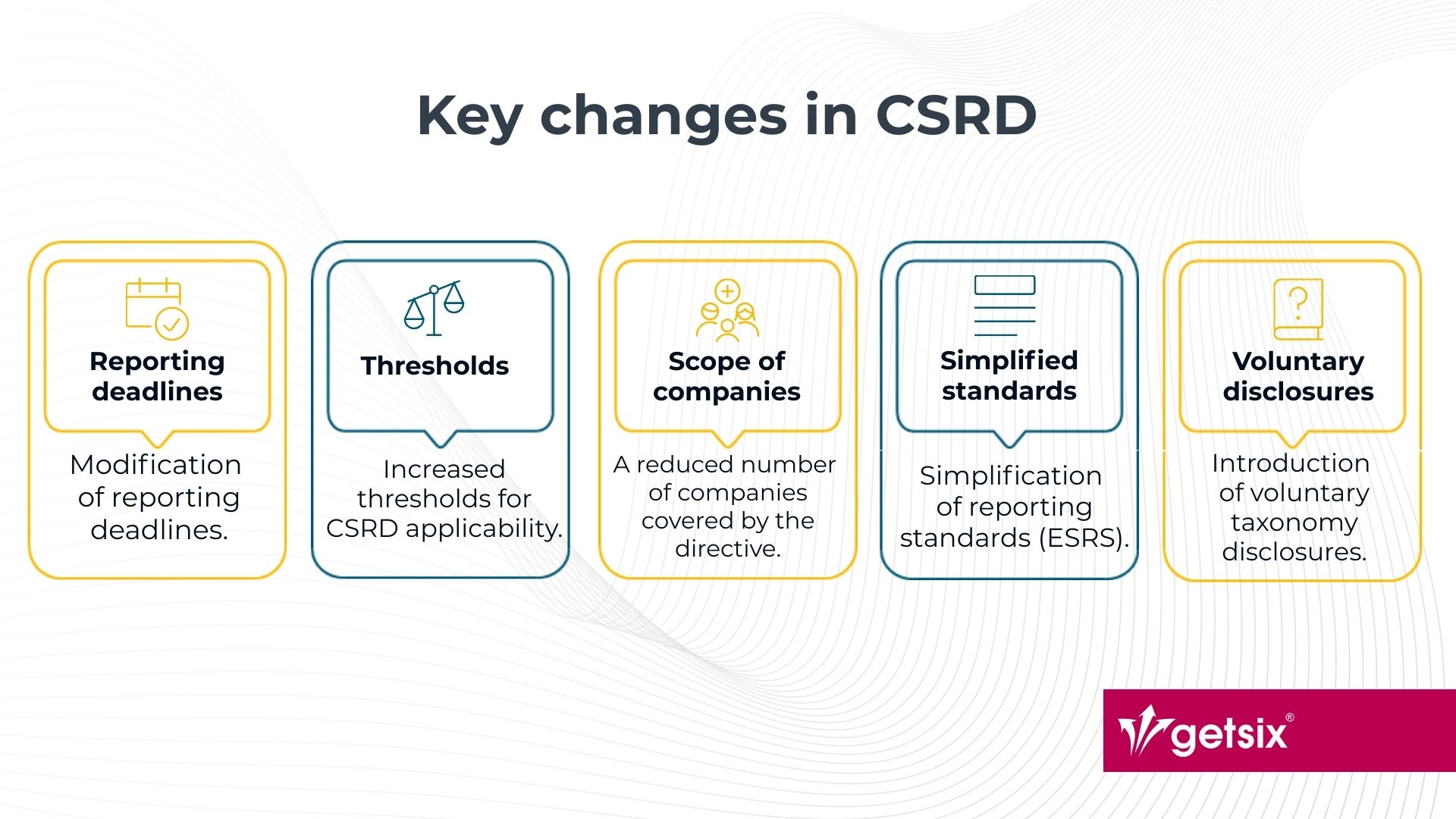

The key changes introduced by the “Stop-the-clock” mechanism are:

This new timeline significantly slows down the pace of implementing EU sustainability regulations and grants companies extra time to prepare for the upcoming requirements.

The “Stop-the-clock” mechanism is part of a larger initiative, the “Omnibus I” legislative package, presented by the European Commission on 26 February 2025. This package was developed in response to strong signals from European companies and industry organisations, who raised concerns about growing regulatory complexity, especially related to ESG. The initiative aims to simplify regulations, enhance competitiveness, and mitigate the risk of regulatory chaos.

In addition to postponing reporting deadlines, the Omnibus package proposes substantial changes within the directives themselves. Significantly, the legislative process occurred at a record pace, taking just 37 days from the initial proposal to the Parliament’s vote.

Under the Omnibus package, a comprehensive revision of the scope and scale of ESG obligations has also been proposed.

The ESG reporting obligation will apply to companies meeting the following criteria:

Consequently, about 80% of companies originally covered by the directive will now be excluded.

The European Commission has announced a reduction in the detail and complexity of ESRS to facilitate implementation, particularly for smaller companies.

Companies with fewer than 1,000 employees and revenues below EUR 450 million will not be obliged to disclose their alignment with the EU Taxonomy (under Article 8 of the regulation); such reporting will become voluntary for these companies.

The postponement of deadlines does not signal a departure from the direction set by the European Union in terms of sustainability. Climate and social objectives remain valid, and ESG obligations – despite their delay – will still have to be met. The “Stop-the-clock” mechanism grants companies extra time but does not exempt them from responsibility. Now is the optimal moment to strategically approach these new regulations: streamline data collection, engage key departments, and integrate ESG into broader management processes. Companies that view this period as preparation time rather than a pause will gain a significant competitive advantage.

Instead of perceiving these delayed deadlines as an excuse to defer action, it’s better to view them as an opportunity. The additional two years represent the ideal moment to establish a solid foundation for ESG reporting, adjust internal processes, and test solutions before they become obligatory. The better your preparation today, the lower your risk of facing challenges tomorrow.

If you have any further questions or require additional information, please contact your business relationship person or use the enquiry form on the HLB Poland website.

***

Download the brochures providing general information and outlining the services that are offered by HLB member firms.

Learn moreClick below for more detailed information regarding population, major towns and cities, language, religion and holidays in Poland.

Learn more