Innovation reliefs – a comprehensive guide for entrepreneurs in Poland

7 November 2025

7 November 2025

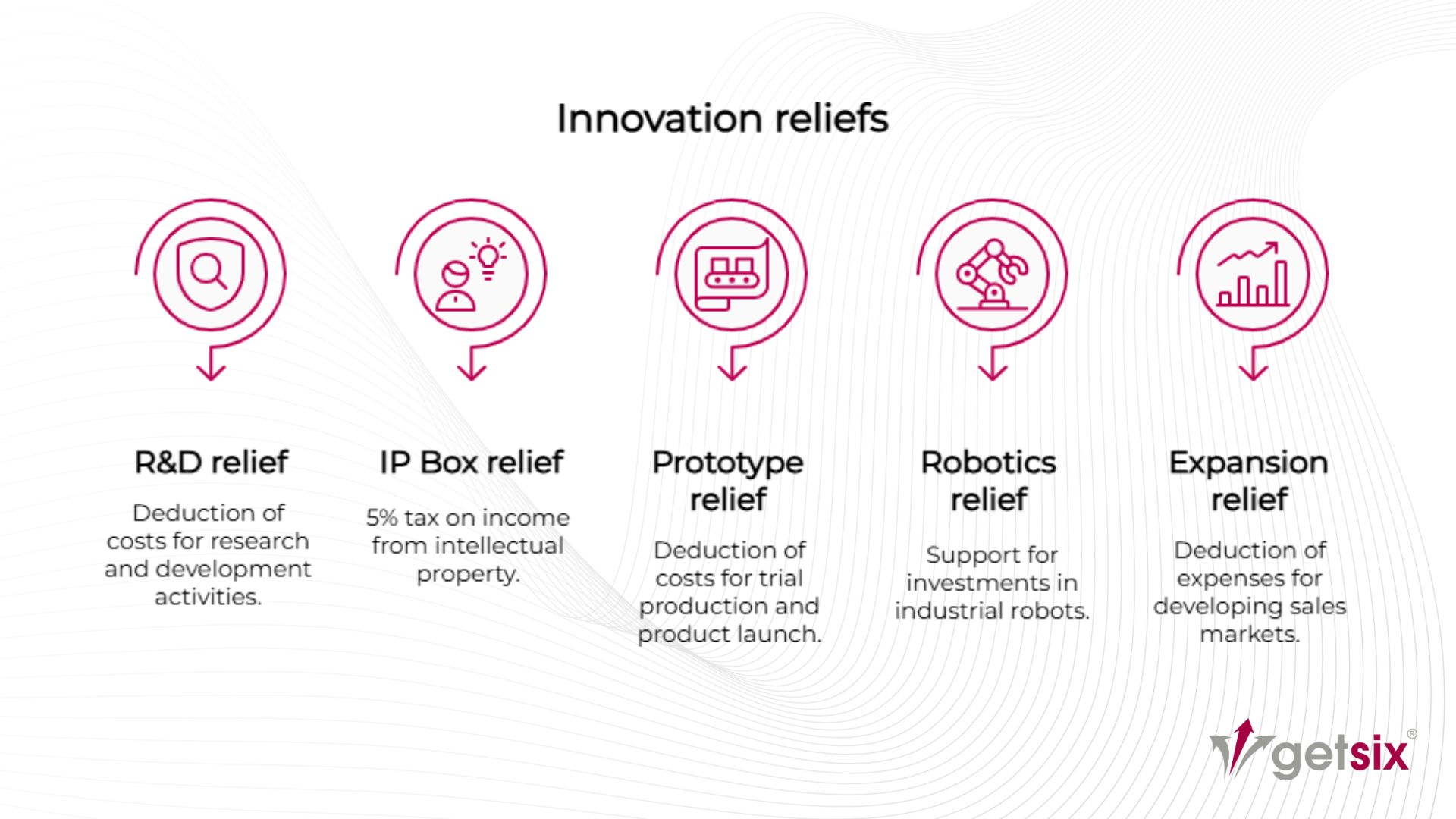

Innovation reliefs are currently one of the key tools supporting the development and competitiveness of companies in Poland. They include a set of tax preferences designed to encourage entrepreneurs to invest in new technologies, products and solutions that improve their operations. These include, among others, tax relief for research and development (R&D) activities, IP Box relief, as well as preferences related to prototyping, robotisation and market expansion.

According to data from the Ministry of Finance on settlements for 2024 and previous years, entrepreneurs are increasingly taking advantage of R&D and IP Box reliefs, and the number of companies implementing robotisation relief is also growing. At the same time, prototype relief and expansion relief remain relatively rarely used. In the rest of this article, we present the most important rules, trends and practical tips to help you safely and effectively take advantage of innovation reliefs.

The term ‘innovation relief’ refers to tax preferences available to both PIT and CIT taxpayers, which are intended to encourage: research and development, IP protection and commercialisation, testing and implementation of new products (prototypes), automation/robotisation of processes, and expansion of sales markets (expansion).

The key to the safe application of reliefs is the correct identification of eligible activities, accurate record keeping and cost allocation.

The research and development relief is one of the most important instruments stimulating innovation. It allows entrepreneurs to deduct eligible costs incurred for R&D work from their tax base – primarily the remuneration of employees involved in research, the costs of materials, expert opinions and auxiliary services.

From 2022, companies will be able to deduct up to 200% of the remuneration costs of employees engaged in development work, which has significantly increased the attractiveness of this preference.

In 2024, 3,541 taxpayers took advantage of the relief, and the value of the deducted costs exceeded PLN 10 billion, growing by almost 20% year-on-year. The data shows that the R&D relief is being used steadily, especially by capital companies.

It is important for companies to accurately document the scope of R&D projects, keep detailed records of working time and maintain consistency with their accounting and tax policies. Since the beginning of 2025, global minimum tax regulations have been in force, covering the largest capital groups – those with consolidated revenues exceeding EUR 750 million. In some cases, the new regulations may limit the effects of tax relief if the total tax rate in a given group falls below 15%. Although this only applies to the largest companies, it is worth being aware that the relief system now operates in a new international tax environment.

The second pillar of innovation reliefs is the IP Box, i.e. a preference allowing a 5% tax rate to be applied to income from eligible intellectual property rights. The relief covers, among other things, patents, protection rights for utility and industrial designs, and copyrights to computer programmes.

To benefit from it, an entrepreneur must meet the requirements of the so-called nexus ratio, which determines the proportion of own costs in the creation of a given IP right, and keep separate records for each project.

In 2024, a record number of 7,650 companies (7,494 PIT, 156 CIT) benefited from the IP Box, and the total amount of tax paid on eligible IP income amounted to PLN 255.4 million.

The most common difficulties are the correct allocation of revenues to individual IP rights and the calculation of income when a product combines several protected solutions. Therefore, well-maintained records and complete technical documentation are of key importance.

The prototype relief is a lesser-known part of the innovation relief system, but it serves an important function: it helps companies move from the research phase to the product launch stage. It allows them to deduct 30% of the costs of trial production of a new product and the costs of its launch, e.g. certification, research or testing.

Despite its potential, only 124 taxpayers took advantage of this preference in 2024, which is a decrease compared to the previous year. The main barriers are complex regulations and unclear definitions – especially of what constitutes ‘trial production’ and what costs can be deducted.

However, the relief has great potential for manufacturing companies that are developing new product lines and need support during the testing phase prior to mass production.

The robotisation relief, introduced in 2022, supports the technological transformation of companies by encouraging process automation. It allows for a 50% deduction of the costs incurred for the purchase and implementation of industrial robots, including accessories, software, integration and training.

In the 2024 tax settlement, 427 taxpayers took advantage of the relief, which is the highest result since its introduction. At the same time, the total amount of deductions decreased, suggesting that more companies are taking advantage of the preference, but investments are smaller on a per capita basis.

Currently, the relief is valid until the end of 2026, and the Ministry of Finance does not plan to extend it. In practice, there are disputes about the timing of the deduction – whether 50% can be deducted from the expense at once or from subsequent depreciation write-offs. It is worth keeping track of interpretations in order to settle the relief correctly.

Another element of the innovation relief system is the expansion relief, also known as the pro-growth relief. It allows for a deduction of up to PLN 1 million per year for expenses incurred for activities increasing revenues from the sale of own products – e.g. participation in trade fairs, promotional campaigns, preparation of offers, adaptation of packaging and labelling to the requirements of new markets.

In 2024, 588 taxpayers took advantage of this preference, slightly less than in the previous year, although the total amount of deductions increased to over PLN 170 million. The biggest challenge remains the inconsistent classification of employee remuneration and marketing costs. In order to reduce the risk, many entrepreneurs secure their position with individual interpretations.

Taking advantage of innovation reliefs is not only a way to reduce taxes, but above all a tool to support the development of modern, competitive companies. However, the key to success is good preparation – clearly defined projects, reliable cost records and consistent documentation. Companies that approach the subject consciously and systematically can not only gain financially, but also strengthen their technological potential and image as a company investing in the future.

If you have any further questions or require additional information, please contact your business relationship person or use the enquiry form on the HLB Poland website.

***

Download the brochures providing general information and outlining the services that are offered by HLB member firms.

Learn moreClick below for more detailed information regarding population, major towns and cities, language, religion and holidays in Poland.

Learn more