Stamp Duty Land Tax (‘SDLT’) is charged on purchases of freehold and leasehold land and property in England, Wales and Northern Ireland.

While Stamp Duty is normally based on the price paid for the property, the tax may also apply where land and property is acquired in exchange for non-cash payment, for example for the transfer of a mortgage or other debt, or in exchange for services etc.

By law, a Stamp Duty return must be filed (and the tax paid) within 30 days of completion. This process is normally managed by a solicitor or conveyancer, who usually files the form and pays the tax on the purchaser’s behalf, adding the cost to their fees.

Different Stamp Duty rates apply, depending on the price of the property and whether it is residential or non-residential.

Residential property

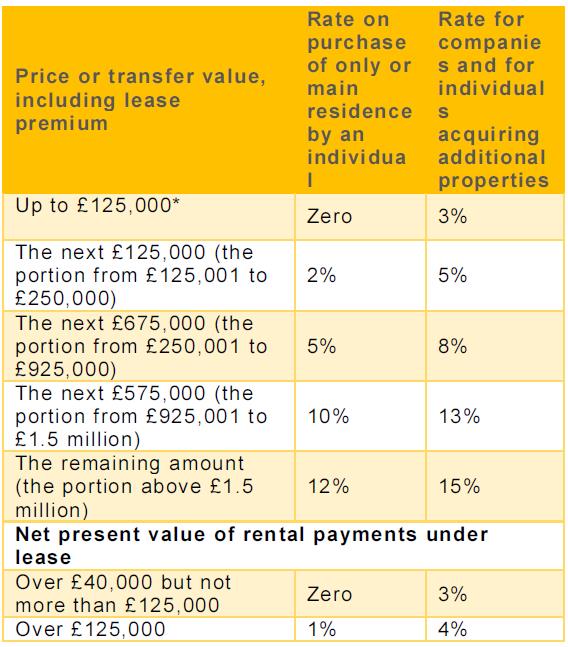

Stamp Duty rates for the purchase of residential property are as follows:

*Transactions for no more than £40,000 are excluded from the surcharge.

Lower rates apply to individuals who replace their only or main residence within three years of selling an existing main residence. Where an existing main residence is not sold at the date of acquiring the new main residence, the higher SDLT rates must be paid, but it may be possible to claim a refund of the additional 3%, if the previous main residence is sold within three years.

Higher Stamp Duty rates apply to all companies. Individuals acquiring a share in a second home or an investment property will also have to pay the higher rate. This applies even when the individual’s other properties are overseas.

Where a leasehold property is acquired, Stamp Duty is paid both on the lease premium and on the net present value of the rentals payable over the life of the lease.

Properties acquired by certain non-natural persons

In law, a ‘natural person’ is an individual person, as opposed to a company or other organisation. Organisations are known by the technical term ‘non-natural persons’.

SDLT is charged at 15% on residential properties costing £500,000 or more, provided they are acquired by non-natural persons who fall within the Annual Tax on Enveloped Dwellings (‘ATED’) regime, unless they are entitled to claim an exemption. Further information on the ATED regime can be found below.

Multiple dwellings relief

Where a purchaser acquires more than one residential property (either in a single or in linked transactions), it’s possible to make a claim for multiple dwellings relief. Multiple dwellings relief works like this: the total amount paid for the properties is divided by the number of properties. Stamp Duty is then calculated at the usual rates on this figure, and the resulting amount is multiplied by the number of properties.

The minimum Stamp Duty charge under this method is 1% of the total purchase price, so if the calculations produce a lower charge, the amount payable is increased to 1%.

Acquisitions of six or more residential properties

Where six or more residential properties are acquired in the same transaction, the lower, non-residential rates of SDLT apply.

Non-residential property

Non-residential property includes commercial properties – such as shops and offices, agricultural land, forests and any other land or property not used as a residence. This also includes mixed use property, i.e. property that has both residential and non-residential elements (for example a building whose lower storey is used a shop).

As mentioned above, if six or more residential properties are purchased in the same transaction fall non-residential Stamp Duty rates apply.

The SDLT rates for acquisitions of non-residential property are as follows:

| Price or transfer value, including lease premium | SDLT rate |

| Up to £150,000 | Zero |

| The next £100,000 (the portion from £150,001 to £250,000) | 2% |

| The remaining amount (the portion above £250,000) | 5% |

| Net present value of rental payments under lease | |

| Over £150,000 but not more than £5 million | 1% |

| Over £5 million | 2% |

Reliefs for builders and property developers

While builders and property developers are generally subject to SDLT like any other purchaser, relief may be available in the following limited circumstances.

Part exchange on new homes

Where a builder acquires a home from an individual, in part exchange for a new home that the builder is building for them, the builder may be exempt from Stamp Duty on the purchase of the old home (if certain conditions are met).

In order for the builder to qualify for exemption, the seller must have lived in the old property as their main residence at some time within the two years before the part exchange. In addition, they must buy a new home from the builder and they must intend to live in the new home as their main residence. There is also a restriction on the size of the land that the builder can acquire with the property. This is normally 0.5 hectares.

Developers subject to planning obligations

In exchange for granting planning permission, planning authorities may require developers to provide community amenities – typically community buildings. These buildings are usually transferred to the local authority once completed, and this can give rise to a double Stamp Duty charge; once on the acquisition of land by the developer, and again on the transfer of the building to the local authority. In these cases the developer can claim relief from SDLT on the first purchase.

Other reliefs

Other reliefs from SDLT are available, for example on certain transactions between group companies and on some acquisitions of property by charities. The rules can be complicated and you should always seek professional advice.

First time buyers

Individuals buying their first home and paying £300,000 or less for a residential property are exempt from Stamp Duty. A first-time buyer paying between £300,000 and £500,000 pays SDLT at 5% on the amount of the purchase price in excess of £300,000. However, if the purchase price is more than £500,000, no relief is due and SDLT is payable in accordance with the normal rates.

Legally, a first-time buyer is defined as an individual or individuals who have never owned an interest in a residential property in the United Kingdom or anywhere else in the world and who intends to occupy the property as their main residence.

Click here to learn more.