The National e-Invoicing System (KSeF) in Poland and the new JPK_VAT structure from 1 February 2026

16 February 2026

16 February 2026

From 1 February 2026, a new version of the Polish VAT reporting structure applies: JPK_V7M(3) for monthly VAT settlements and JPK_V7K(3) for quarterly settlements.

The change applies under Polish tax law and affects all active VAT taxpayers in Poland submitting JPK_VAT files for periods starting from February 2026.

The key practical change is closely linked to the implementation of the National e-Invoicing System (KSeF) in Poland. In the VAT records section of JPK_VAT, taxpayers must now indicate either:

Even though the mandatory use of KSeF is introduced gradually in 2026, the new JPK_VAT structure applies universally, regardless of when a given company becomes subject to mandatory e-invoicing.

For more context on why these changes were introduced, see our earlier post: Draft regulation: new invoice markings in JPK_VAT in connection with KSeF.

The new JPK_VAT variants must be submitted for the first time for February 2026, within the standard deadline applicable to that settlement period.

This obligation covers both:

as the VAT records section is still submitted on a monthly basis, even under quarterly settlement rules.

A critical compliance point is that the requirement to report a KSeF number or OFF/BFK/DI is assessed as at the moment of submitting the JPK_VAT file.

In practice, this means that the decisive factor is the status of the document on the filing date, not the transaction date or the invoice issue date.

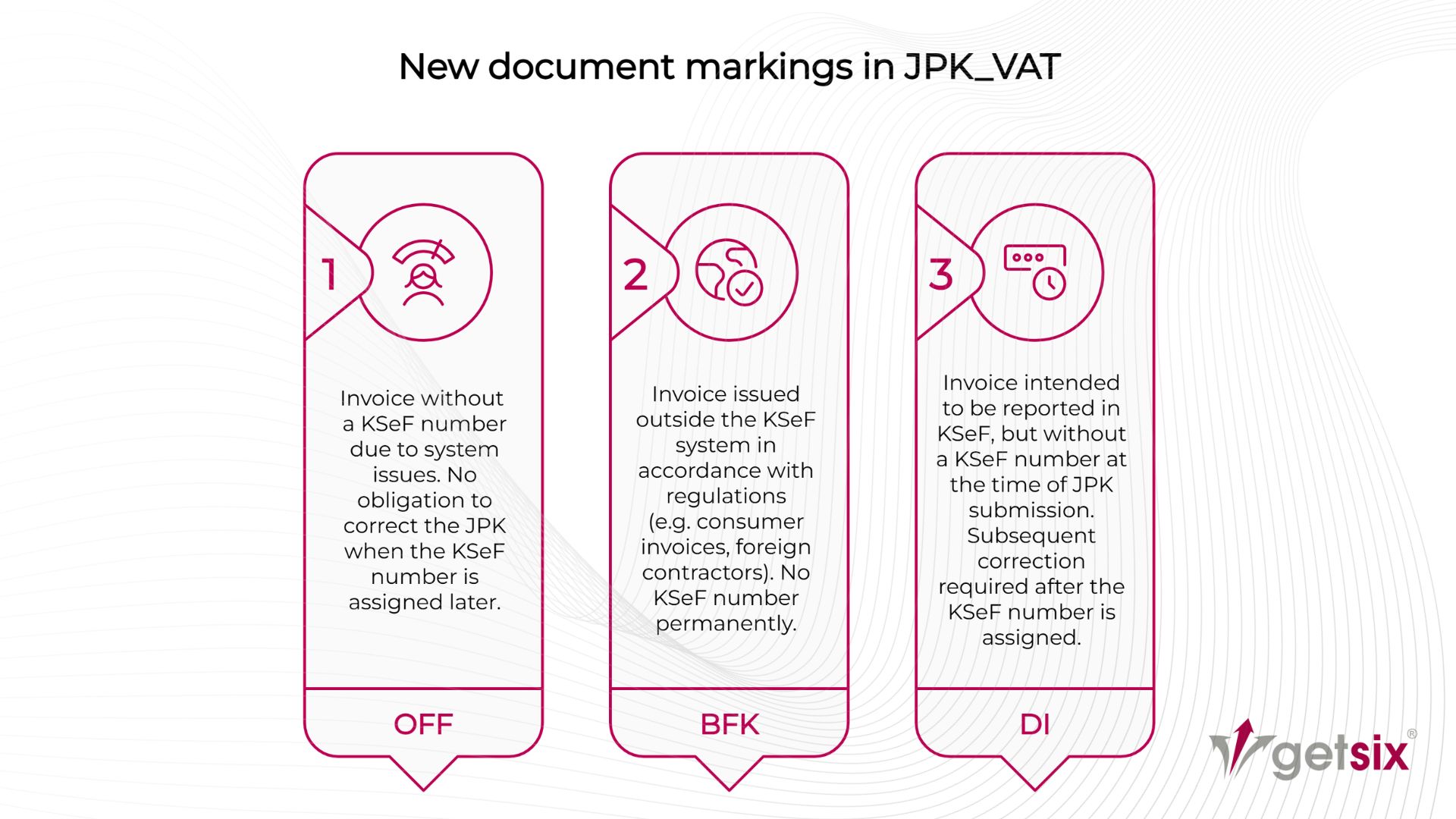

Under the updated JPK_VAT structure, only one value may be reported per entry. Taxpayers must indicate either the KSeF number or exactly one reason code explaining its absence:

From an organisational perspective, this requires companies to define clear and strict internal rules determining:

The OFF code applies where invoices are issued during technical failures on the KSeF side, and no KSeF number is available at the time of JPK_VAT submission.

An important practical consequence is that, as a rule, OFF does not automatically require a JPK_VAT correction solely to supplement the KSeF number if it becomes available later. This distinguishes OFF from DI in terms of follow-up obligations.

BFK covers invoices issued outside KSeF in situations explicitly permitted by Polish VAT regulations, such as B2C invoices or other transactions not processed through the Polish e-invoicing system.

For internationally operating companies, BFK is often relevant on the purchase side, where VAT records include documents received from foreign suppliers that are not part of the Polish KSeF framework.

DI is a temporary indicator showing that a document is reported without a KSeF number, even though such a number is expected to be assigned later in the normal course of events.

The key compliance implication is procedural: once the KSeF number becomes available, companies should be prepared to correct the VAT records and replace DI with the KSeF number, if required by the applicable regulations.

Yes. The new JPK_VAT structure does not eliminate existing markings such as GTU, RO, WEW, FP, TP or IMP. These codes continue to apply alongside the new KSeF-related requirement.

In practice, a single VAT entry may include:

For example, in VAT settlements related to import of goods (IMP), DI may still apply if no KSeF number is available at the time of filing and the structure requires justification for its absence.

From a management and compliance perspective, two areas require particular attention:

The decision whether to report a KSeF number or OFF/BFK/DI is made at the moment of submitting JPK_VAT. This requires coordination between invoicing teams, accounting and IT systems.

Where DI situations occur, companies should clearly define:

Regardless of ongoing discussions on penalties related directly to KSeF invoicing, JPK_VAT reporting risks remain significant.

If the head of the competent Polish tax office identifies errors in VAT records that prevent proper verification of transactions, the taxpayer will be formally requested to:

Only if the taxpayer fails to respond on time, responds late, or does not effectively refute the identified errors, may the tax authority impose a financial penalty of PLN 500 per error by administrative decision.

Importantly, sanctions are not automatic and are linked to the correction procedure and the taxpayer’s response.

The following steps usually deliver the fastest compliance benefits:

For organisations with complex VAT structures, international transactions or fragmented IT systems, a process-based implementation approach is often the most effective way to ensure OFF/BFK/DI rules are aligned with accounting and document workflows from day one.

At getsix®, within our accounting services in Poland, we support businesses in structuring VAT records, defining reporting rules and ensuring that JPK_VAT reporting remains consistent with operational documentation and Polish compliance requirements. Contact us.

Legal basis:

If you have any further questions or require additional information, please contact your business relationship person or use the enquiry form on the HLB Poland website.

***

Download the brochures providing general information and outlining the services that are offered by HLB member firms.

Learn moreClick below for more detailed information regarding population, major towns and cities, language, religion and holidays in Poland.

Learn more