Company accounting policy in Poland – what is it, how to prepare it, and why is it important?

14 July 2025

14 July 2025

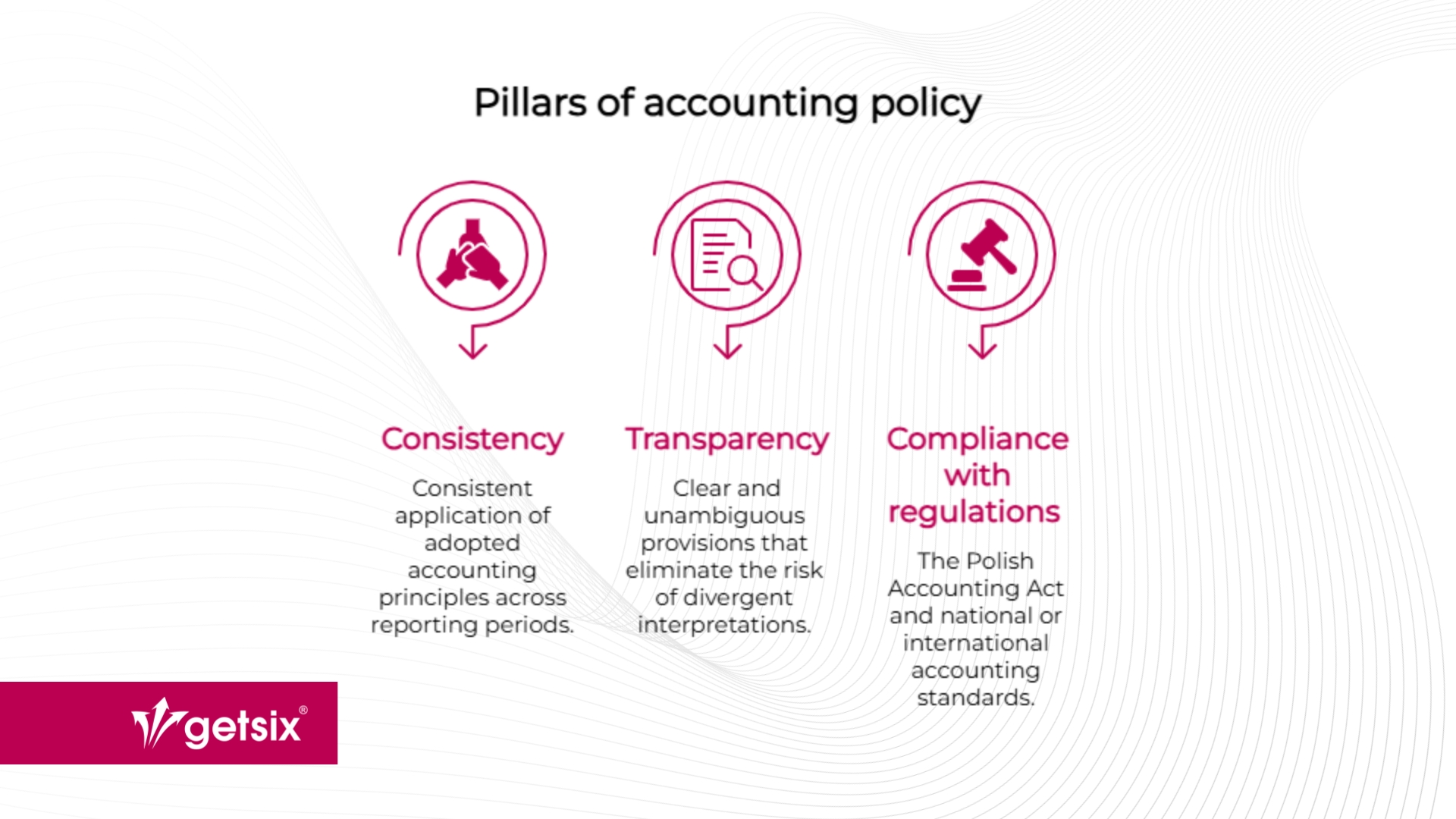

An accounting policy is not just a formal requirement. It is the foundation on which a company’s entire financial reporting is built. A well-defined and consistently applied accounting policy enhances transparency, supports compliance with regulations, and builds trust among investors, business partners, and financial institutions.

An accounting policy is an internal document of an entity which sets out the accepted principles, methods, and procedures for keeping accounting records and preparing financial statements. In practice, it acts as a comprehensive instruction manual for managing financial information in the company – indicating how to record, value, and present business events in accordance with applicable Polish regulations.

An effectively developed accounting policy is based on three key pillars:

The primary legal source regulating accounting policy in Poland is the Accounting Act of 29 September 1994. According to Article 10 of this Act, every entity keeping accounting books is required to develop and implement documentation specifying the adopted accounting principles (accounting policy).

The obligation to prepare an accounting policy applies to entities that, under the Accounting Act, are required to maintain full accounting books. This includes, in particular, entities with their registered office or management in Poland, such as:

If you are unsure whether your company is subject to the obligation of preparing an accounting policy, consult a tax adviser or accounting office. Proper classification of the entity’s status is crucial for regulatory compliance.

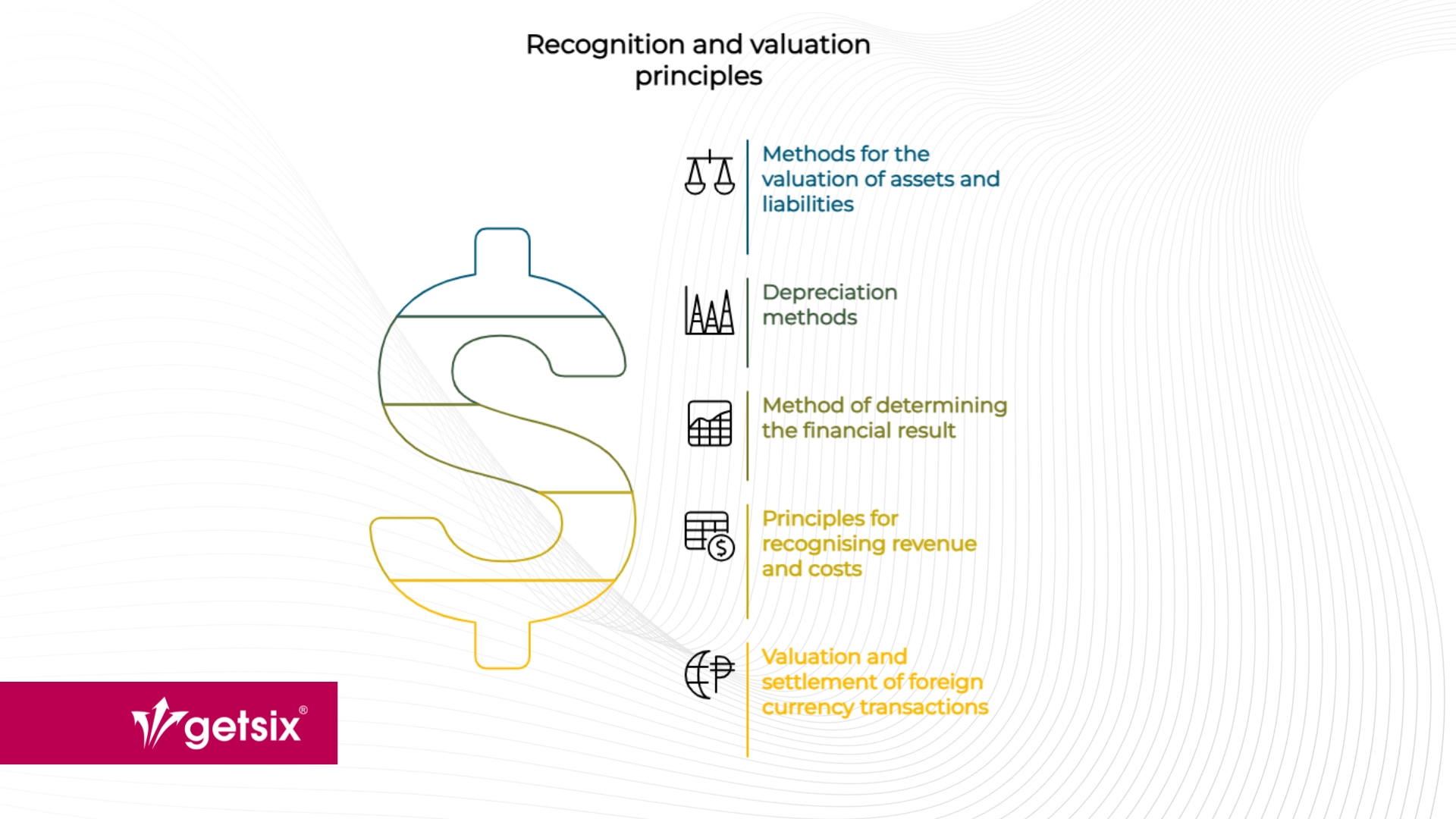

An accounting policy should reflect the specific nature of the entity’s operations. However, in accordance with the Accounting Act, there is a set of essential elements that must be included in every such document. Their proper specification ensures consistency of financial data and compliance with reporting standards.

The accounting policy should not only be legally compliant but also practical – tailored to the real needs and scale of the business.

Responsibility for preparing and implementing the accounting policy formally lies with the head of the entity – i.e. the person or body managing the company. In capital companies, this is usually the management board; in partnerships – the partners managing the company’s affairs; and in foundations or associations – the management board or another executive body.

This responsibility is both personal and formal – the lack of an accounting policy or its incorrect preparation may result in liability under fiscal penal law (Article 77 of the Accounting Act).

Although the document must be signed and adopted by the entity’s head, its technical preparation may be delegated to:

It is advisable to seek support from experienced professionals who will tailor the content to the nature of the business and current regulations.

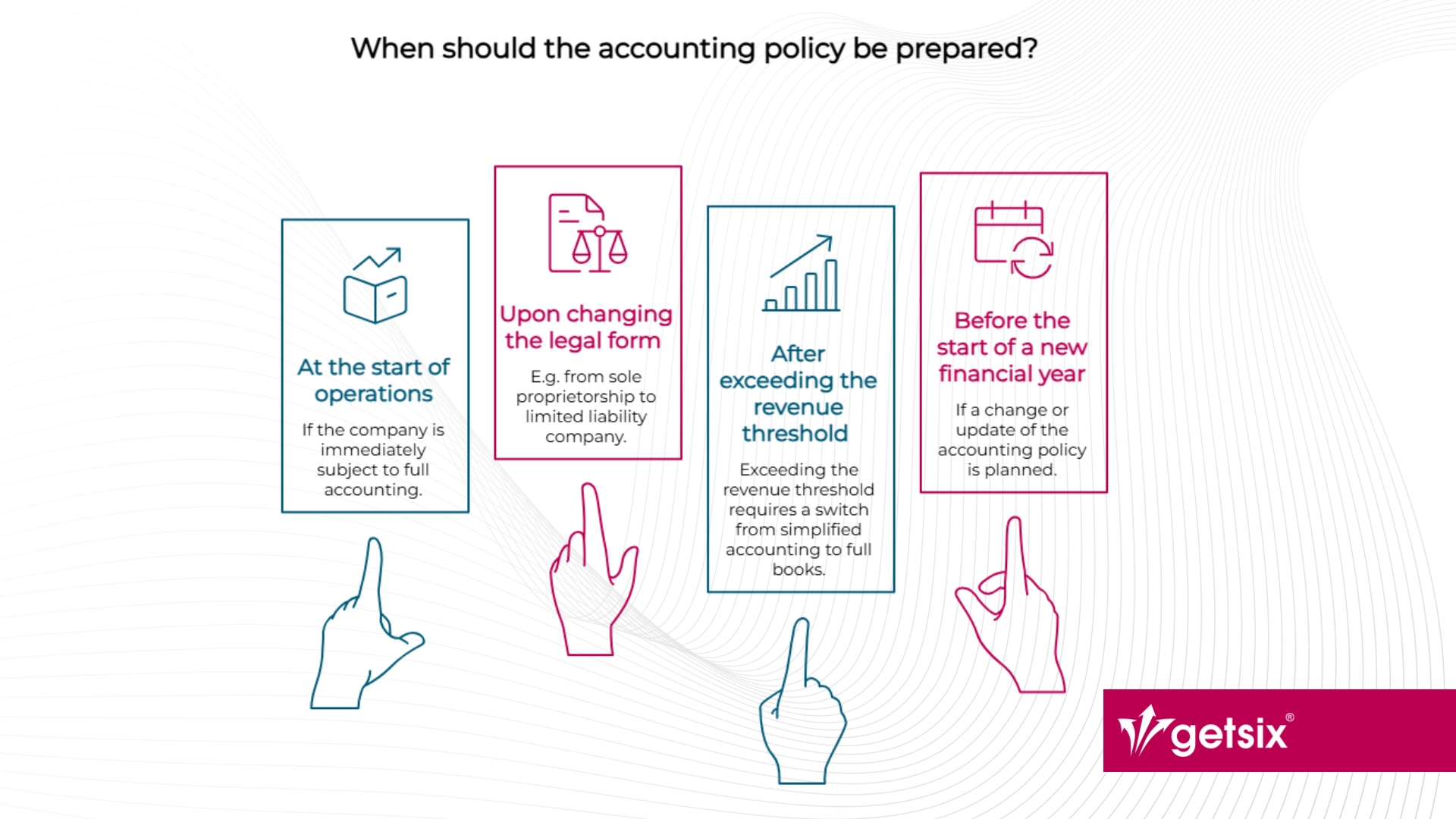

The accounting policy must be prepared before the commencement of keeping accounting books, that is:

Failure to prepare and implement an accounting policy can have serious consequences:

A well-prepared accounting policy is a key component of internal control systems and a guarantee of the reliability of financial reporting.

Preparing the document is only the first step. For the accounting policy to be effective and formally valid, it must be officially adopted and documented.

In companies, implementation typically takes place by means of a management board resolution confirming:

In a limited liability company (Sp. z o.o.) or a simple joint-stock company (PSA), this will usually be a resolution of the management board. In partnerships (e.g. general, professional, limited partnerships), the decision to adopt the accounting policy is taken by the partners managing the company’s affairs – in the form of an agreement or resolution, depending on the adopted mode of operation.

📌 The document should be signed by authorised persons and stored as part of the accounting documentation – together with the possible adopting resolution.

The getsix® team not only prepares complete accounting policies tailored to the specific nature and structure of your company but also:

Thanks to this, our Clients can be confident that their accounting policy is not only legally compliant but also effectively implemented and ready to be applied in daily operations.

Would you like to discuss your company’s situation? Contact getsix® to receive personalised advice and documentation support.

All entities that are obliged to maintain accounting books under the Polish Accounting Act must have an accounting policy. This includes, among others, commercial companies, natural persons exceeding a specified revenue threshold, financial sector entities, and entities that voluntarily opted for full accounting. It is worth verifying the entity’s status and the point at which this obligation arises.

The accounting policy is formally prepared by the entity that is obliged to keep accounting books – the entire process is the responsibility of the entity’s head (e.g. company management board, partners). The document, however, can be technically prepared by an accounting office, chief accountant, or tax adviser. It is essential that the policy complies with legal requirements and reflects the nature of the company’s operations.

Lack of an accounting policy constitutes a breach of the Accounting Act and may lead to serious consequences. These include the accounting books being considered unreliable, fiscal penal liability of the entity’s head, and problems during tax inspections or audits. It also increases the risk of errors and discrepancies in financial records.

An accounting policy is a set of rules and procedures that precisely define how business events should be recorded and how financial statements should be prepared. A properly developed and regularly updated policy improves transparency, reduces the risk of errors, and facilitates managerial decision-making.

Developing an accounting policy is not a formality – it is a strategic decision that supports financial stability and security. It is a document that provides a coherent framework for keeping accounting books, ensures compliance with applicable Polish regulations, and strengthens credibility in the eyes of business partners, financial institutions, and supervisory authorities.

Safeguard your company’s financial integrity.

The getsix® team will help you develop an accounting policy that complies with the law and fits your business realities.

If you have any further questions or require additional information, please contact your business relationship person or use the enquiry form on the HLB Poland website.

***

Download the brochures providing general information and outlining the services that are offered by HLB member firms.

Learn moreClick below for more detailed information regarding population, major towns and cities, language, religion and holidays in Poland.

Learn more