The National e-Invoice System (KSeF) is a solution that will become mandatory for most taxpayers in Poland from 2026. The system introduces a new model for the circulation of invoices – structured electronic documents stored in the central system of the Ministry of Finance. This is a fundamental change that affects daily business processes, accounting and relations with contractors.

The Ministry of Finance has prepared the ‘KSeF 2.0 Manual’, which describes in detail, among other things, the principles of the system’s operation and the subsequent stages of preparation for its implementation. This document is an official source of information, containing both legal basis and practical guidelines for entrepreneurs. Based on the content of the handbook, we present below a comprehensive guide that discusses, step by step, the actions necessary to efficiently start using KSeF.

KSeF implementation schedule

- 1 January 2022 – launch of the voluntary version of KSeF.

- 25 June 2025 – publication of the new FA(3) logical structure.

- 30 June 2025 – release of the KSeF 2.0 API technical documentation.

- 30 September 2025 – launch of the KSeF 2.0 API test environment.

- 1 November 2025 – possibility to download KSeF certificates.

- 3 November 2025 – release of the KSeF 2.0 Taxpayer Application for testing.

- 1 February 2026 – obligation to issue invoices in KSeF for taxpayers who exceeded PLN 200 million in sales in 2024.

- 1 April 2026 – obligation extended to other taxpayers.

- 31 December 2026 – end of the transition period for the smallest entrepreneurs (sales up to PLN 10,000 per month).

- 1 January 2027 – full implementation of KSeF, no possibility of issuing invoices using cash registers, obligation to provide KSeF numbers in payments between active VAT taxpayers and the possibility of applying sanctions for failure to comply with obligations.

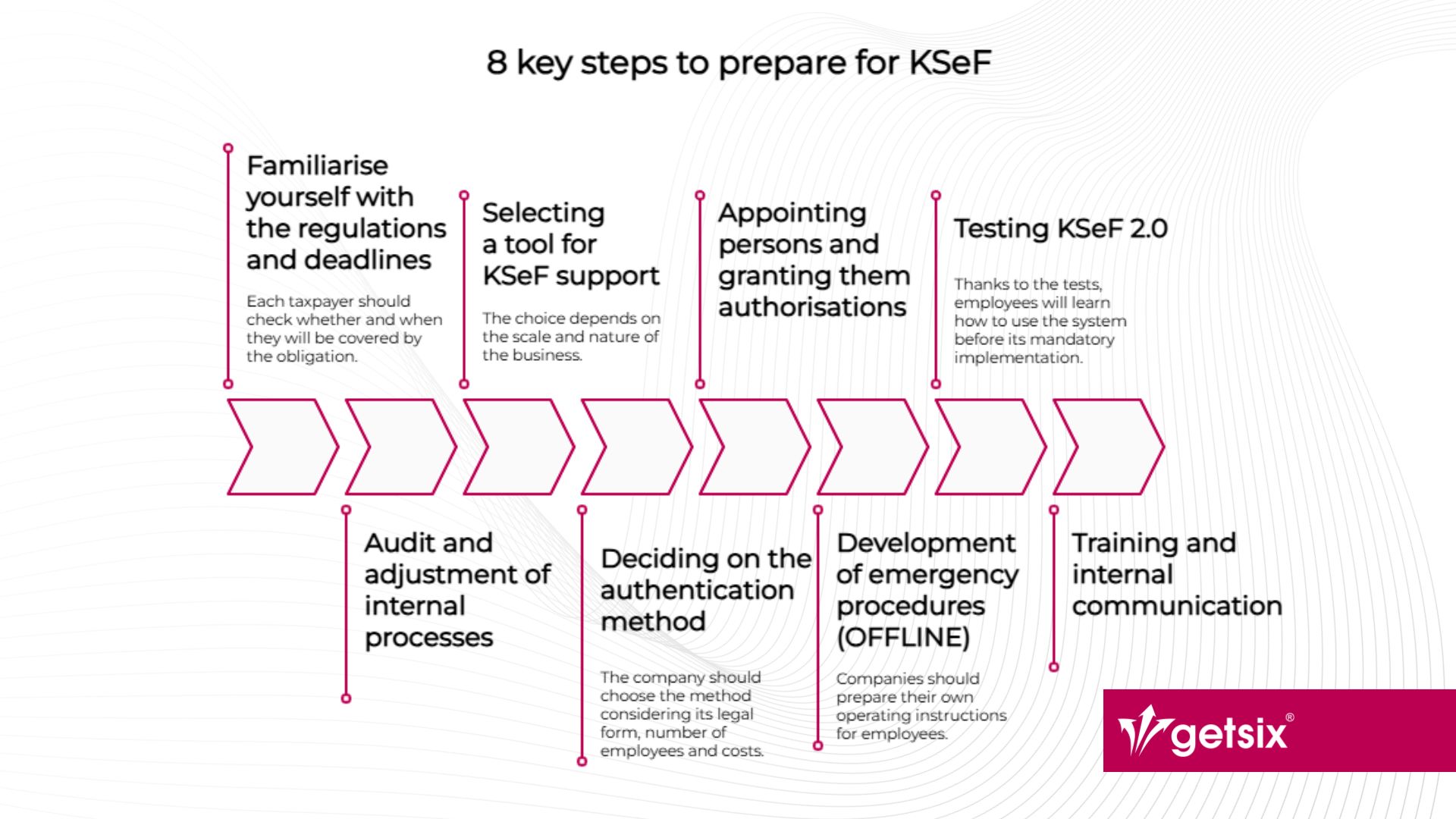

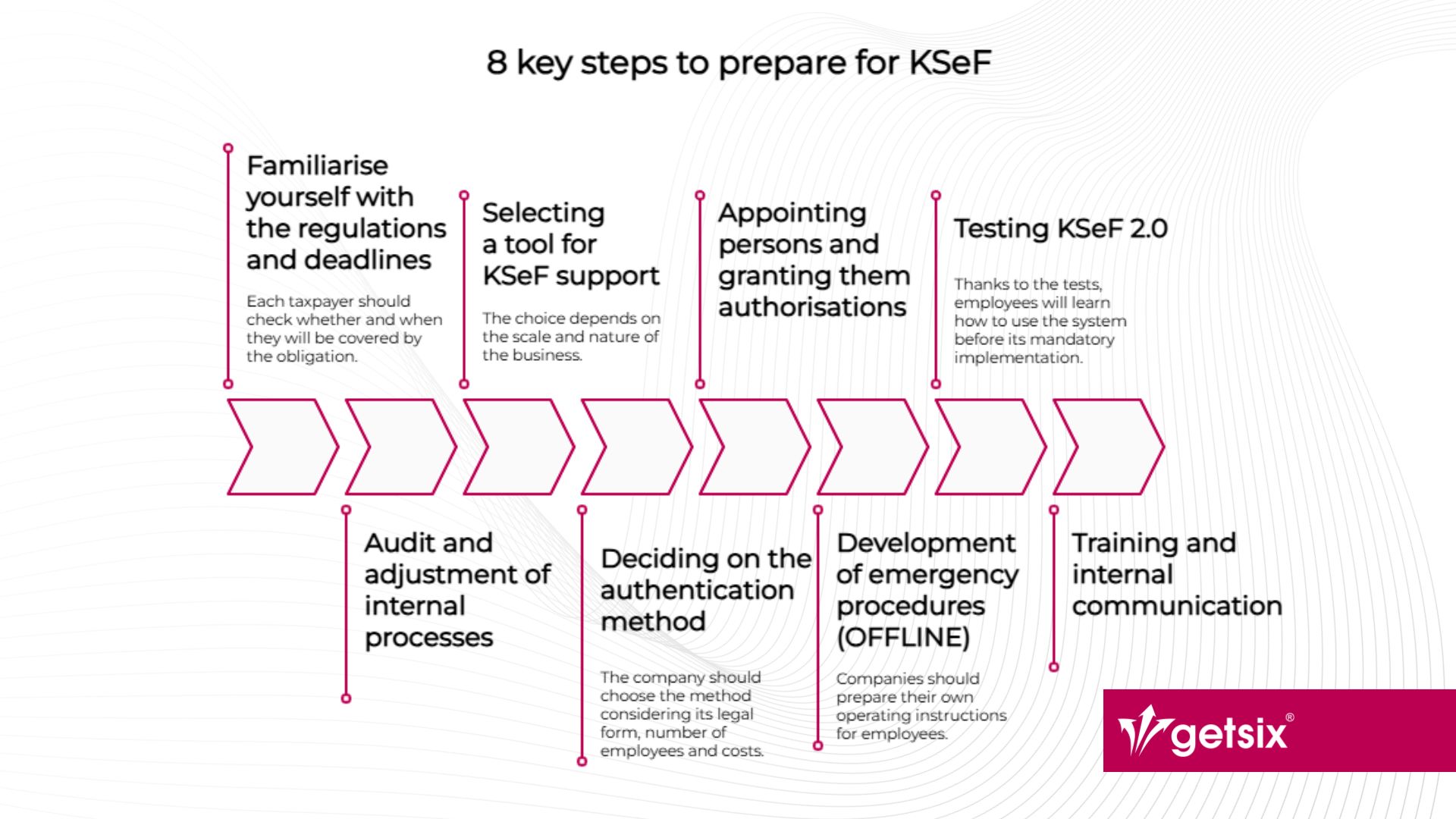

8 key steps to prepare for KSeF

Step 1. Familiarise yourself with the regulations and deadlines

The basis for preparation is an analysis of the legal regulations (acts of 2023, 2024 and 2025) and an understanding of the deadlines for the obligation to come into force. Each taxpayer should check whether and when they will be covered by the obligation and whether their activity falls within the scope of exemptions.

Step 2. Audit and adjustment of internal processes

This is the most labour-intensive step, but it is crucial for the success of the entire implementation. The audit should determine:

- Types of invoices – KSeF supports basic, advance, settlement, simplified and corrective invoices. It is not possible to issue pro forma invoices, credit notes, debit notes or bills, among others.

- Additional industry-specific fields – e.g. in the energy sector: meter numbers, in transport: carrier details – you need to check how they are reflected in the FA(3) structure.

- Attachments – KSeF only supports structured XML attachments (e.g. goods specifications). It does not accept PDF files or scans. Such documents will have to be sent through other channels.

- Document flow in the company – who issues, who approves, who accounts for, how invoices reach the accounting office.

- Relationships with contractors – e.g. foreign contractors who do not have access to KSeF (no VAT number) or consumers who need to be provided with an additional form of invoice.

Step 3. Selecting a tool for KSeF support

Options for entrepreneurs:

- Free MF tools – KSeF 2.0 Taxpayer Application, e-mikrofirma, KSeF mobile application (especially for the smallest companies).

- Commercial financial and accounting systems – integrated with KSeF 2.0 API, better for large-scale businesses.

The choice depends on the scale and nature of the business – micro-entrepreneurs can use free tools, while large companies are more likely to integrate KSeF with ERP.

getsix® supports companies in the process of adapting to KSeF. As a Microsoft partner, we implement Microsoft Dynamics 365 Business Central, fully integrated with KSeF and streamlining financial and accounting processes. We also offer the Customer Invoice and Workflow Portal with a mobile application – a modern tool for the circulation, approval and verification of invoices. We encourage you to contact the getsix® team to choose the optimal solution for your company.

Step 4. Deciding on the authentication method

Access to KSeF is possible, among others, through:

- Trusted Signature (for individuals, free of charge),

- qualified electronic signature,

- qualified electronic seal,

- KSeF certificates – a new method recommended by the Ministry of Finance:

- type 1 certificate – for authentication in the system,

- type 2 certificate – for issuing invoices offline.

The company should choose the method considering its legal form, number of employees and costs.

Step 5. Appointing persons and granting them authorisations

Roles and responsibilities must be defined:

- who issues sales invoices,

- who verifies and approves purchases,

- who prepares tax returns,

- who outside of accounting needs access (e.g., complaints department, logistics).

It is important to consider substitutes in case of absence and planned personnel changes.

Step 6. Development of emergency procedures (OFFLINE)

KSeF provides for three emergency modes:

- offline24 – in the event of no internet connection,

- offline – system unavailability (maintenance work),

- emergency mode – failure announced by the Ministry of Finance.

Invoices in these modes are issued in the FA(3) structure and then sent to KSeF within a specified time limit:

- 1 working day (offline24 and system unavailability),

- 7 working days (emergency mode).

A KSeF certificate is required to work offline. Companies should prepare their own operating instructions for employees.

Step 7. Testing KSeF 2.0

The API test environment has been available since September 2025, and the KSeF 2.0 Taxpayer Application test will be available from November 2025. Every entrepreneur should use this time to:

- Test the process of issuing and receiving invoices,

- Check the correctness of integration with the financial and accounting programme,

- Test authorisation and login,

- Check the handling of emergency modes.

Thanks to the tests, employees will learn how to use the system before its mandatory implementation.

Step 8. Training and internal communication

The final step is organisational preparation:

- keeping track of the KSeF website and Ministry of Finance announcements,

- organising training for employees,

- appointing a team responsible for supervising the implementation,

- ensuring that all departments know how the new rules will affect their daily work.

Exemptions from mandatory KSeF

Not all invoices will have to be issued in the system. Exemptions include, among others:

- invoices issued by foreign taxpayers without a registered office or permanent place of business in Poland,

- sales to consumers (issuing invoices in KSeF is voluntary),

- OSS and IOSS procedures and international occasional transport,

- invoices in the form of single-use tickets (motorways, rail, air and sea transport),

- certain VAT-exempt services.

In practice, this means that some companies will have to run parallel processes – in KSeF and outside it.

Preparing for KSeF requires action on many levels: from familiarising oneself with the regulations, through process auditing and selecting the right tools, to testing and training the team. Although the obligation will be implemented in 2026, it is worth starting work now to avoid the risk of chaos and ensure the smooth functioning of the company in the new system.

KSeF is an obligation, but also an opportunity for standardisation and automation of document circulation, greater financial transparency and better control over tax settlements.

getsix® offers comprehensive e-invoicing solutions tailored to the size of your company and the specifics of your industry. Our support helps you to fully prepare for the changes introduced by KSeF – please contact us for more details.

If you have any further questions or require additional information, please contact your business relationship

person or use the enquiry form on the HLB Poland website.

Contact us »

***

This publication is non-binding information and serves for general information purposes. The information

provided does not constitute legal, tax or management advice and does not replace individual advice. Despite

careful processing, all information in this publication is provided without any guarantee for the accuracy,

up-to-date nature or completeness of the information. The information in this publication is not suitable as

the sole basis for action and cannot replace actual advice in individual cases. The liability of the authors

or getsix® are excluded. We kindly ask you to contact us directly for a binding consultation if required.

The content of this publication iis the intellectual property of getsix® or its partner companies and is

protected by copyright. Users of this information may download, print and copy the contents of the

publication exclusively for their own purposes.