Employee Capital Plans (PPK) are a new private system of long-term savings based on the co-operation between employees, employers and the state.

PPK will apply to every person registered for mandatory pension insurance, i.e. all persons employed under employment contracts, civil law contributions, members of supervisory boards receiving remuneration – this also applies to foreigners.

The Handling of the Employee Capital Plans Programme (PPK) Takes Place on the Following Basis:

| Age of the employee |

Rules for the Application of PPK |

| Under 18 years of age |

Are excluded |

| 18 to 55 years of age |

Mandatory participation in the program, there is a part you can withdraw from |

| 55 to 70 years of age |

Can voluntarily join the program |

| Over 70 years of age |

Are excluded |

The funds collected in PPK’s account are private assets of the employee and are invested in securities (shares, bonds) of a defined date. As the age of the participant increases, the investment risk of accumulated funds is to decrease. In practice, this means that in the beginning more money will be invested in shares and related instruments, which potentially have a chance to generate more profit. With the age of the participant, a greater part of the assets will be invested in safer tools (including Treasury bonds). The entities which can manage PPK’s funds are Investment Fund companies, Common Pension companies and Social Insurance Institution (ZUS).

General Terms

The law on PPK came into force on 1st July, 2019. Depending on the size of the company, employers are obliged to conclude a PPK Management Contract in accordance with the following calendar:

- From 1st July, 2019 companies with more than 250 employees as at 31st December, 2018.

- From 1st January, 2020 companies with more than 50 employees as at 30th June, 2019.

- From 1st July, 2020 companies with more than 20 employees as at 31st December, 2019.

- From 1st January, 2021 all remaining companies (including public financial sector units).

Exceptions: If the eligible entity as above is part of a capital group, small entities in that group may also be subject to PPK. However, a single small company cannot apply to the PPK before the conditions as above.

Specific Terms

-

For Companies with more than 250 Employees

- You should have concluded a PPK Management Contract with the selected financial institution by 1st July, 2019 and should have been concluded before 25th October, 2019.

- The contract for managing the PPK should have been concluded by 12th November, 2019.

-

For Companies with more than 50 Employees

- You can conclude a PPK Management Contract with the selected financial institution from 1st January, 2020 and no later than 24th April, 2020..

- An agreement on the management of PPK accounts must be signed by 11th May, 2020.

-

For Companies with more than 20 Employees

- You can conclude a PPK Management Contract with the selected financial institution from 1st July, 2020 and no later than 27th October, 2020.

- An agreement on the management of PPK accounts must be signed by 10th November, 2020 at the latest.

-

Remaining Companies

- You can conclude a PPK Management Contract with the selected financial institution from 1st January, 2021 and no later than 23rd April, 2021.

- An agreement on maintenance of PPK accounts must be signed latest till 10th May 2021.

For public financial sector units:

- You can conclude a PPK Management Contract with the selected financial institution from 1st January, 2021 and no later than 26th March, 2021.

- An agreement on maintenance of PPK accounts must be signed latest till 10th April, 2021.

The Amount of the Contributions

Contributions are payable from the next month following the month in which the PPK contract was concluded. Payments financed by the employing entity and by the participant of PPK are calculated on the date of payment of the salary. The PPK contributions are to be calculated in the wage payment period. Contributions to financial institutions must be paid by the 15th of the month, following the month in which they were calculated and subtracted.

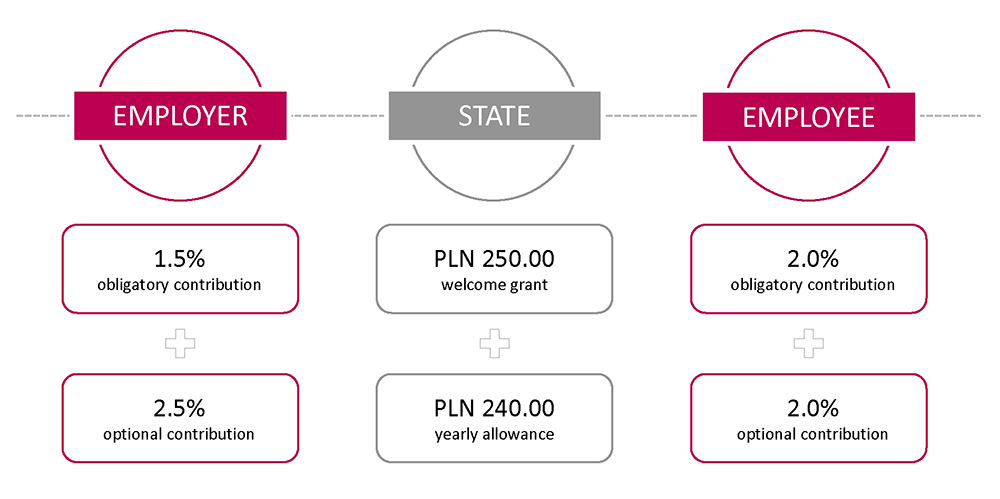

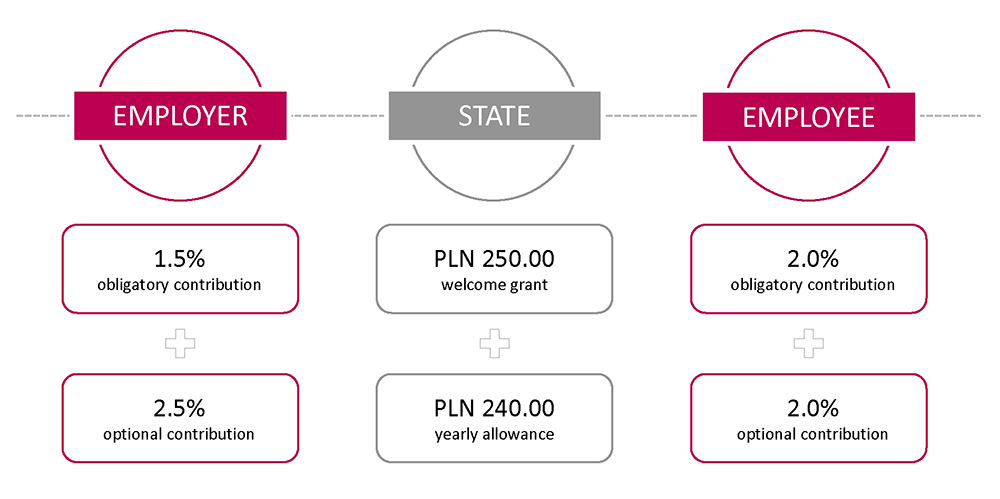

The contributions structure looks as follows:

- Employee’s contribution: the obligatory contribution amounts to 2% of the gross salary, or 0.5%-2% of the salary when the employee earns less than 120% of the minimum salary. Additionally, an employee may declare a voluntary contribution of up to 2% of his or her salary.

- State subsidies: The Labour Fund finances a welcome payment of PLN 250.00 and an annual subsidy of PLN 240.00. The welcome payment will be credited on the PPK participant’s account after 3 full months of participation in the PPK, if the payments have been made for those months. The annual allowance will be paid to the employee’s account no later than the 15th April of the following year. The condition for receiving the allowance is that the amount of basic contributions calculated for a period of 6 months from the minimum wage (if the participant of the PPK receives a wage lower than 120% of the minimum wage 25% of the indicated amount) financed by the participant of the PPK is credited to his/her PPK account in a given calendar month.

- Employer’s contributions: the obligatory contribution amounts to 1.5% of the employee’s gross salary, while the additional voluntary contribution can be set up to 2.5%. The additional payment may vary from the employer depending on the length of the employment period (management contract), or on the basis of the salary regulations.

Stages of Joining (Employers’ Obligations):

- Analysis of offers from financial institutions.

- Establishment of employee representation (when there are no trade unions).

- Conclusion of the PPK Management Contract (company + financial institution).

- Conclusion of a management contract for PPK – employee application.

- The service from PPK:

- Calculation and making payments,

- administration of employee resignation,

- change in contributions.

Full information can be obtained from the government website: www.mojeppk.pl.

If you have any questions, please contact our customer desk, or use the contact form on our website.

***

This newsletter is a non-binding information and serves for general information purposes. The information provided does not constitute legal, tax or management advice and does not replace individual advice. Despite careful processing, all information in this newsletter is provided without any guarantee for the accuracy, up-to-date nature or completeness of the information. The information in this newsletter is not suitable as the sole basis for action and cannot replace actual advice in individual cases. The liability of the authors or getsix® are excluded. We kindly ask you to contact us directly for a binding consultation if required. The subscription to this newsletter does not constitute a client relationship. The content of this publication is the intellectual property of getsix® or its partner companies and is protected by copyright. Users of this information may download, print and copy the contents of the newsletter exclusively for their own purposes.

We are an independent member of HLB. THE GLOBAL ADVISORY AND ACCOUNTING NETWORK.