3 reasons why you should expand your business within Europe | amavat

6 August 2019

6 August 2019

There are limited growth opportunities in each market place, so you might be wondering how can you scale your business even more? Can I generate more sales and grow my online business?

But then again why expanding into EU markets and not others which are larger than Europe? Firstly, the EU is a great region to expand into because of its mature economy and its size. Secondly, the European marketplace is also culturally close to yours and also very well covered by Amazon. So you can strongly increase your sales by making Europe an integral part of your online business, and of course Amazon makes it very simple for sellers to reach into other European marketplaces. Simply by using Amazon’s current infrastructure, you can touch an enormous audience of consumers within Europe.

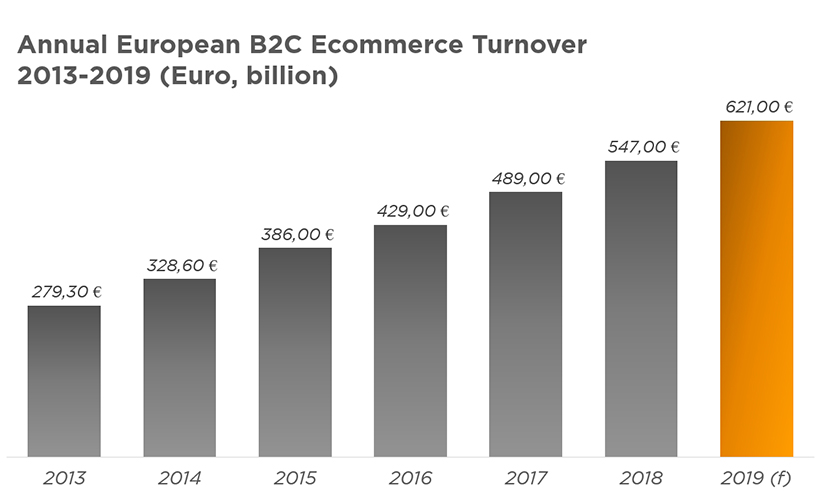

Why not let amavat® assist you? We can help you do it right, then you can benefit from a growing market. For your information – the expected annual turnover in B2C eCommerce in Europe should hit €621 billion in 2019, compare that to 2013 when it was only €279.3 billion.

Amazon over time has established large marketplaces in five European countries that can help you to reach 27 countries within the EU.

The benefit to you: If you have an EU selling account on Amazon you are then able to sell in various marketplaces from a single account: simplifying listing, pricing, fulfillment, and being paid. When you sign up to sell with an Amazon Europe Marketplace Account, your seller account is automatically enabled to allow you to sell on all Amazon EU marketplaces:

When you use Amazon’s European FBA services and also get your goods into Amazon warehouses across Europe, this enables them to ship from these warehouses, which provides a much better customer experience, with quicker deliveries. You should use Amazon to store and deliver across Europe, as well as their customer support and returns service.

To summarise, the 3 key reasons why you should expand across Europe:

Sell across 27 countries on Amazon’s European marketplaces.

This will make stronger your cash flow, protecting you from sales variations on one particular marketplace, while taking advantage of European holiday seasons and peak sales periods across all different marketplaces.

You can leverage their state-of-the-art logistics, powerful tools, and world-class customer service to streamline your international selling, so that you can focus on growing your online business.

Not everyone wants to start selling to all marketplaces from the outset, so where should your second country be? You should choose where to grow based on your specific circumstances, considering your product category, resources and other factors.

Generally, it makes a lot of sense to consider the largest marketplaces first, as you can expect the largest growth for your business in those markets. The UK and Germany are great choices to start with as many sellers expanding into the EU from the American marketplace start in the UK, since both marketplace languages are English.

For an example – sending your inventory to a UK fulfillment centre is a common initial entry strategy. At that point, you can use the BIL tool to translate and synchronise your listings to start selling in the remaining marketplaces, using Amazon’s European Fulfillment Network (EFN). This will then automatically fulfil orders across all five marketplaces using your single source of inventory in the UK. Once you’re ready, you can then explore other fulfillment options, for instance Multi-Country Inventory and Pan-European FBA.

You could also store your goods in Poland or the Czech Republic, if you already have established your growth to the German marketplace. This will give you the benefit of €0.50 saving on shipping through Amazon fulfillment fees per unit shipped from your German inventory (stored in Germany, Poland, and the Czech Republic). There are also three further logistic centres which are state-of-the-art and 24 hour operations, seven days per week, providing faster delivery to an ever growing customer base in Southern and Eastern Germany and Eastern Europe through their strategically positioned logistic centres in Poland and the Czech Republic. Additionally, you can take advantage of increased shipment efficiency, as inward shipments only require to be sent to one logistics centre.

EFN allows you to store goods in different fulfillment centres within one country from which you’re local and cross-border orders will be fulfilled. You can still sell to all marketplaces through EFN, even if your goods a stored on only one country. Amazon’s EFN infrastructure is a very good start for your online business, if you do not want to store your goods in several countries.

You can find our more information here.

The CE option lets you distribute your FBA inventory to a warehouse in Germany, then Amazon will handle the delivery to Amazon’s fulfillment centres in Germany, Poland and the Czech Republic all at Amazon’s discretion, and to use this service there are no additional FBA fees. You will require to be VAT registered in those 3 countries, with the main benefit being the money that you can save, specifically €0.50 of the fulfillment fee for every unit sold from Germany, Poland or the Czech Republic.

You can find our more information here.

Amazon through PAN EU allows sellers to send their goods to a warehouse and Amazon distributes these goods internally to all its warehouses – free of charge. Your customers benefit from quicker shipping times and you (the retailer) only pays local shipping costs. If you are possibly a seller in America, then you would already know this structure.

You can find our more information here.

Even though it is fairly simple to expand with the EU using Amazon, of course there are some challenges you will still require to deal with when expanding your business within the European Union.

You will require to know whether your product is suitable for that country, then you will require to check if there are would-be customers for your product in that market. But most importantly, make sure you comply with all laws in each country and to match the product standards in each country.

Amazon needs listings and customer support provided in the marketplace’s local language.

Each EU Member State has tax requirements for sales of goods to customers. As a PAN-European Amazon seller you will require 5 sales tax numbers (German, the UK, Italy, France and Spain).

VAT and how to deal with it?

VAT is a consumption tax that applies to goods and services that are bought and sold for consumption in Europe. VAT is collected from the buyer at the ‘point of sale’ and is specific for each EU country. As a seller, you will be required to forward this VAT payment to the countries revenue authority on precise dates. Which means when you import goods into the EU, you will require to observe the customs laws. When you store goods, or sell goods to customers within the European Union, you will be required to register for VAT in that country.

It is very important that you are tax compliant, because it is you who will have to pay any financial penalties, if for whatever reason you didn’t register for VAT when you were required to and the tax authorities became aware of this. The sum of the fine usually depends on the amount of VAT due and the amount of time you failed to meet your registration responsibilities. Generally a percentage based fine on the VAT amount that should have been remitted to the tax authorities is required for late registration.

Additionally, Amazon will receive a confirmation by the tax authorities that you have indeed failed to stay compliant, so they are required to de-list you from Amazon marketplaces, this of course will prevent you from listing your goods until you are VAT compliant again. It is very important to avoid this possible scenario so that your business is not affected.

Selling across Europe is a serious responsibility, but at the same time allows you to greatly increase your sales by reaching millions of new customers.

Maintaining VAT compliance is very important and you must fully consider all regulations, why not discuss with our amavat® experts to evaluate your individual situation. amavat® assists and can guide you to stay VAT compliant in all European marketplaces. We offer VAT registrations and also VAT returns and filings to online sellers.

For further information please do not hesitate to contact us here.

The information contained above is of a general nature and does not concern the situation of a specific company. Due to the speed of changes occurring in EU legislation, we kindly ask you to determine, on the date of this information, whether it is still up to date.

Download the brochures providing general information and outlining the services that are offered by HLB member firms.

Learn moreClick below for more detailed information regarding population, major towns and cities, language, religion and holidays in Poland.

Learn more